Introduction

CharityEngine offers an integrated automatic credit card updater. This feature will assist organizations in further optimizing their giving levels by reducing decline levels and inaccurate information for your recurring and repeat donors. This integration can be configured at your needs to support your sustainers and/or donors who donate more frequently.

The Automated Credit Card Updater is a service provided by some credit card companies and payment processors to merchants. It is designed to help merchants automatically update the credit card information of their donors when the card details change, such as when a card expires or is replaced due to loss or theft.

When a customer's credit card information changes, such as a new card being issued with a different expiration date or card number, it can be challenging for merchants to keep that information up to date. This can be particularly problematic for businesses that rely on recurring payments, such as subscription-based services or membership organizations. If the customer's card information is not updated promptly, the merchant may encounter payment failures or decline, resulting in lost revenue.

It is important to note that not all credit card companies or payment processors offer this service, and it may also depend on the specific agreements between the merchant and the payment processor. Additionally, customers have the option to opt-out of the Automated Credit Card Updater service if they prefer not to have their card information automatically updated.

The main benefits of the Automated Credit Card Updater service include reducing payment disruptions, minimizing manual efforts for merchants, and improving customer satisfaction by ensuring uninterrupted services.

Table of Contents

Prerequisites

-

- Additional fees will apply - please see your account manager for more details on this feature and to learn more about the benefits to your donation revenue channels.

Instructions

If your account is participating in the Credit Card Updater feature, you can establish the updating feature to maximize your organization's donation revenue stream.

Step 1: Navigate to the Configuration App > Billing > Card Updater

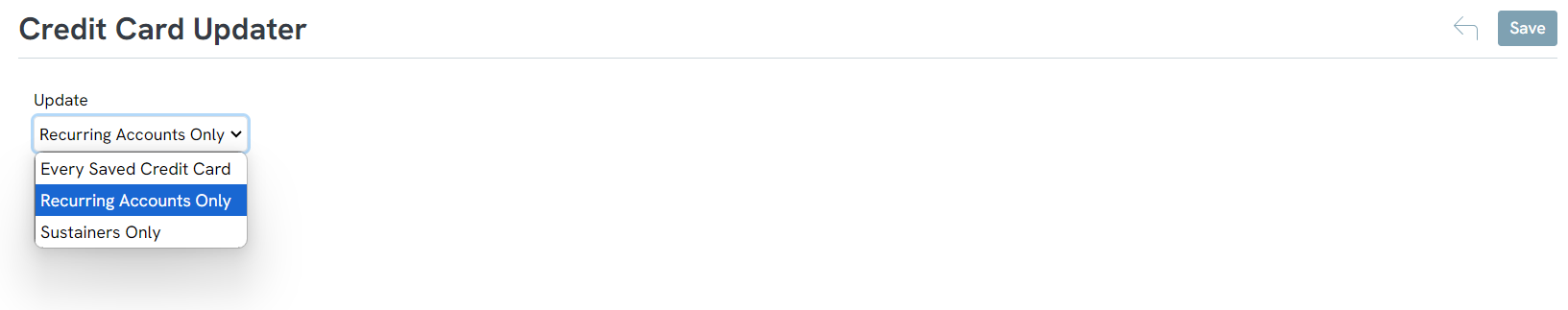

Step 2: From the Update drop down select from one of the available options

-

-

- Every Saved Credit Card - any credit card that has been captured for recurring payments and/or in which a donor has stored for future usage with other donations

- Recurring Accounts Only - any credit card that has been captured for infrequent recurring payments

- Sustainers Only - any credit card that been captured for a sustainer record

-

Reporting

Reporting is available for users who have activated the CAU integration.

Step 1: Navigate to the Reports App > Data Enrichment > Card Type CAU Stats

Step 2: While the default time frame will be YTD, use Quick Filters to adjust time frames

Reports will provide the user with:

- Updates by card type

- Request count - total count of credit cards considered

- Update count - total count of updated credit cards

- Updated revenue - total dollar of saved revenue which may have been alternatively declined as a transaction

FAQs & Further Reading

Q. Once the Credit Card Updater is activated, what can I expect next?

A. Upon initial activation, the updater will evaluate credit cards for potential update. This may result in an initial increase in updater fees but will normalize during the recurring updating process.

Q. When are fees applied?

A. Fees are only applied when a credit card has been updated through the network.

Q. Are credit cards only evaluated when they are no longer valid/declined?

A. No. This may also include updates on valid credit cards which have an identified change - reducing any impact to potential upcoming revenue.